- Afponline cost of capital registration#

- Afponline cost of capital professional#

Afponline cost of capital registration#

To make your registration over the phone, call Pearson VUE’s registration center at 86.įor online registration, visit the Pearson VUE website.Īfter you have registered online or over the phone, you will wait to receive authorization to take the test via the mail. To successfully register, you will have to pay a registration fee of $186.00.

Registration for the exam is done online or over the phone.

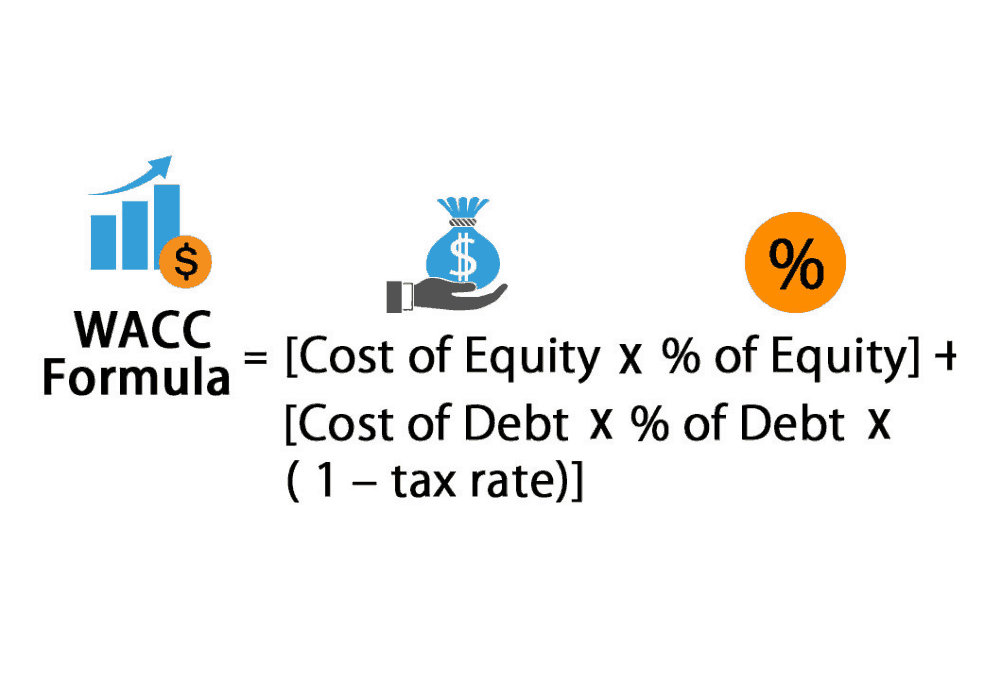

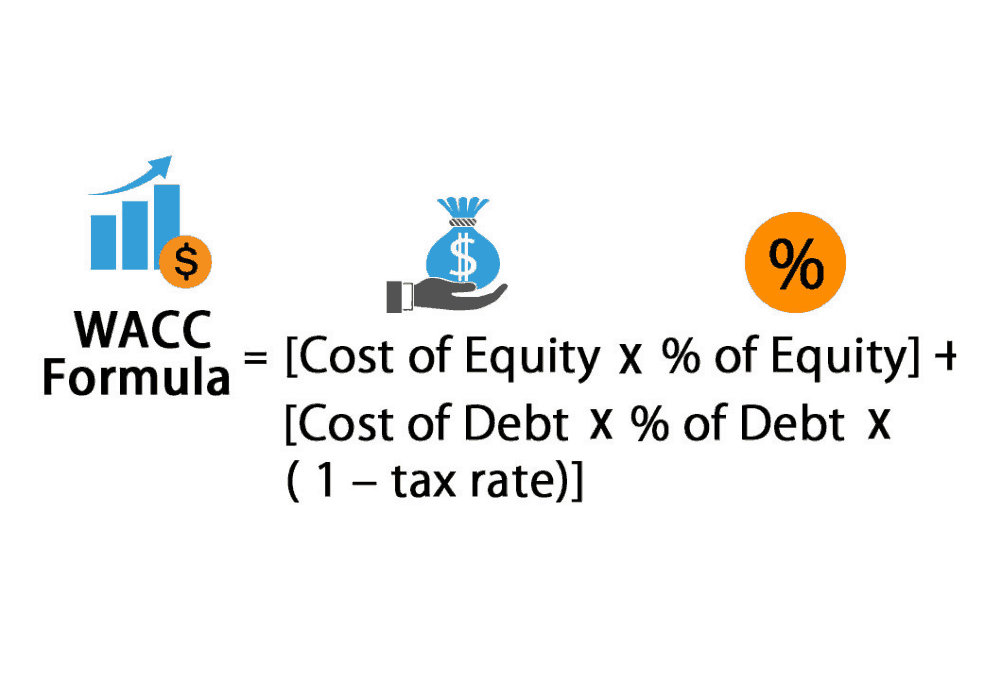

Monitor information security risks and cyber‐related risks (including e‐mail scams, phishing scams). Identify security issues and concerns associated with new and existing technology. Specifically, Domain 5 covers the following topics: This domain is about assessing impact of technologies on the treasury function. Ensure regulatory compliance, and report internally and externally on compliance. Hedge FX, interest rate, and commodities exposure. Develop, maintain, and test business continuity plans (including bank balance reporting process, funds transfer capabilities). Evaluate and manage counterparty risk (including risk related to supply chain, banks, brokers, dealers). Benchmark performance against external sources to ensure best practices (including banking fees comparative analysis). Detect and mitigate fraud (such as payments, bank transactions, internal, and external). Draft treasury policies and procedures for approval including FX, risk management, hedging, credit approval. Comply with treasury policies and procedures (such as investment, FX, risk management, hedging, credit approval). Specifically, Domain 4 covers the following topics: This domain is about monitoring and controlling corporate exposure to financial, regulatory, and operational risk (including emerging and reputational risk). Build and maintain relationships with internal stakeholders (including accounting, IT, legal, and tax departments). Manage merchant services programs (including fees, risk, controls, card security compliance, retention requirements). Serve as an internal trusted advisor and consultant (including Project Finance). Identify, negotiate, and select relationships and operational agreements with external service providers (including financial, technological, and investment/retirement advisors) to ensure best practices and competitive pricing. Administer bank accounts (including bank fee analysis) and maintain documentation. Evaluate and implement treasury products and services (including banking products, treasury workstations). Build, maintain, and review relationships with external financial service providers. Specifically, Domain 3 covers the following topics: This domain is about managing internal and external relationships. Evaluate current market conditions (including credit availability, spreads, interest rates, terms, risk) as they relate to long‐term borrowing strategies. Assess the impact of mergers, acquisitions, and divestitures. Negotiate and manage syndicated agreements. Specifically, Domain 2 covers the following topics: This domain is about managing capital structure, managing costs of long-term capital, and quantitatively evaluating long-term capital resource investments. Calculate, analyze, and evaluate financial ratios to optimize financial decision-making. Optimize treasury operations (including considerations for roles/responsibilities and outsourcing options). Review cash balances and reconcile transaction activity to ensure accuracy. Ability to manage intercompany financing (may include loans, repatriation, and in-house banking procedures). Ability to manage trade financing, including letters of credit.

Ability to recognize and leverage cash consideration and pooling structures. Ability to forecast and manage cash receipts and disbursements. Ability to manage optimal cash positioning using short-term investing and borrowing procedures. Specifically, Domain 1 covers the following topics: This domain is about maintaining corporate liquidity required to meet current and future obligations in a timely and cost-effective manner. The exam contains 5 domains, which are outlined below.

Ability to recognize and leverage cash consideration and pooling structures. Ability to forecast and manage cash receipts and disbursements. Ability to manage optimal cash positioning using short-term investing and borrowing procedures. Specifically, Domain 1 covers the following topics: This domain is about maintaining corporate liquidity required to meet current and future obligations in a timely and cost-effective manner. The exam contains 5 domains, which are outlined below. Afponline cost of capital professional#

The Certified Treasury Professional Exam contains 170 questions, all of which are multiple-choice, and the time limit is 3.5 hours. Get practice questions, video tutorials, and detailed study lessons Get Your Study Guide Exam Outline Review Check Out Mometrix's Certified Treasury Professional Study Guide

0 kommentar(er)

0 kommentar(er)